This is tonight’s ETF Research Report explaining what is happening with the markets right now. Lots of uncertainty heading into the Fed interest rate decision come Wednesday. For gold it’s still all about the dollar.

NOTE: Update on calculations of the trading data for green weekly to red weekly trades. I should have some data by mid-week. I am excited to see what the data says as I haven’t had time to personally calculate everything. I can only do so much. But I know some of the ETF returns will reveal a new and better strategy with the Service moving forward.

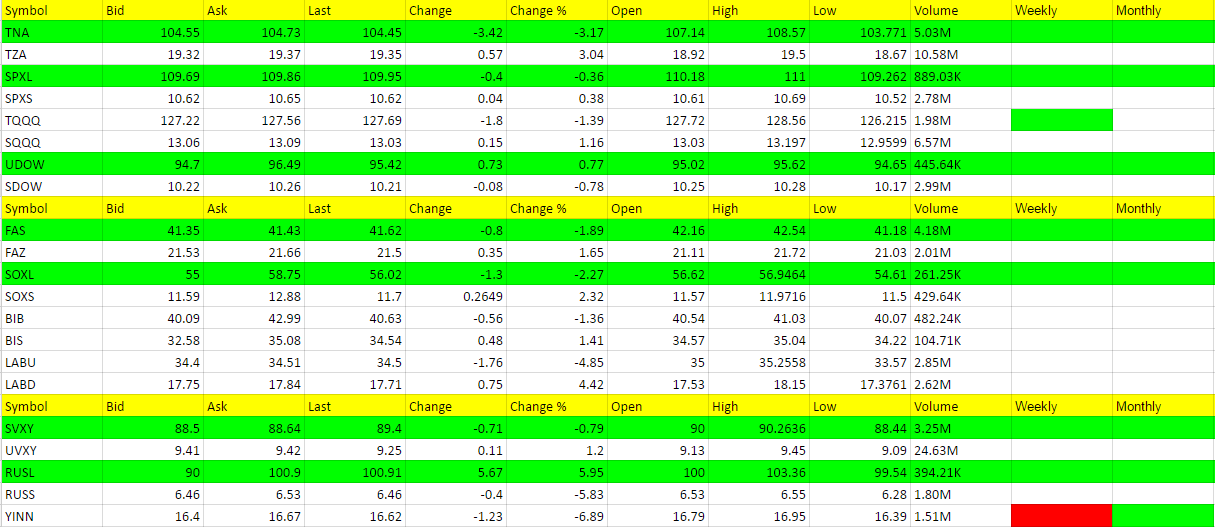

Trades for Today

Today was a scalping trade at best. We took some profit from DGAZ and JDST with 1/2 shares or a scalp and kept a stop thereafter, 2.5% from the highs leaving us with some profit in DGAZ and about flat to a hair lower in JDST. We then jumped ship into JNUG and again nothing more than a scalp and 2.5% dip from that 7 mark high would have you out at 6.82. In looking at it as a trade after that, nothing was worth taking the risk overnight with Fed volatility in full force.

Economic Data for Tomorrow

Some important data tomorrow that can play on YANG if we contemplate going long in the morning. Lots of data with Japan tomorrow night. But only Redbook and Export Import data tomorrow. Nothing big. But API Weekly Crude Oil Stock later in day. I would be out oil before any reports.

Interest rate decision on Wednesday. Expect some volatility.

Stock Market

Markets fell asleep after lunch and were somewhat volatile today not offering us much. We did take UVXY home with us and are up in after hours trading. We will probably have a range bound day tomorrow and we’ll keep an eye on what the best trade setup looks like. Futures did at least tank some after being higher earlier, but are right at that support area of 2250. A break below 2248 tomorrow would have me leaning short the market ETFs. Over 2253, long the market. But that’s a very tight range so I’ll wait to see what the market brings a day before the Fed. Then Wed. we can expect some fireworks. Keep an eye on TLT being up for the day to confirm your shorts and vice versa.

My speculation is a a move higher to trap more bears after the Fed, and then a complete reversal lower.

Foreign Markets

In last nights report I said RUSL is green and now we have a new ally of Putin with Exxon CEO being added as Secretary of State. It gapped up pretty big today but we didn’t chase it. Seems like everything is going Russia’s way. But I think the real story might be long YANG here. We may have got a scalp at best out of it today but I think we’ll start seeing it pop a little as YINN just turned red on the weekly.

Interest Rates

TLT again looking more attractive and did end up higher by .22 today. I would be a buyer at open tomorrow if up for a scalp.

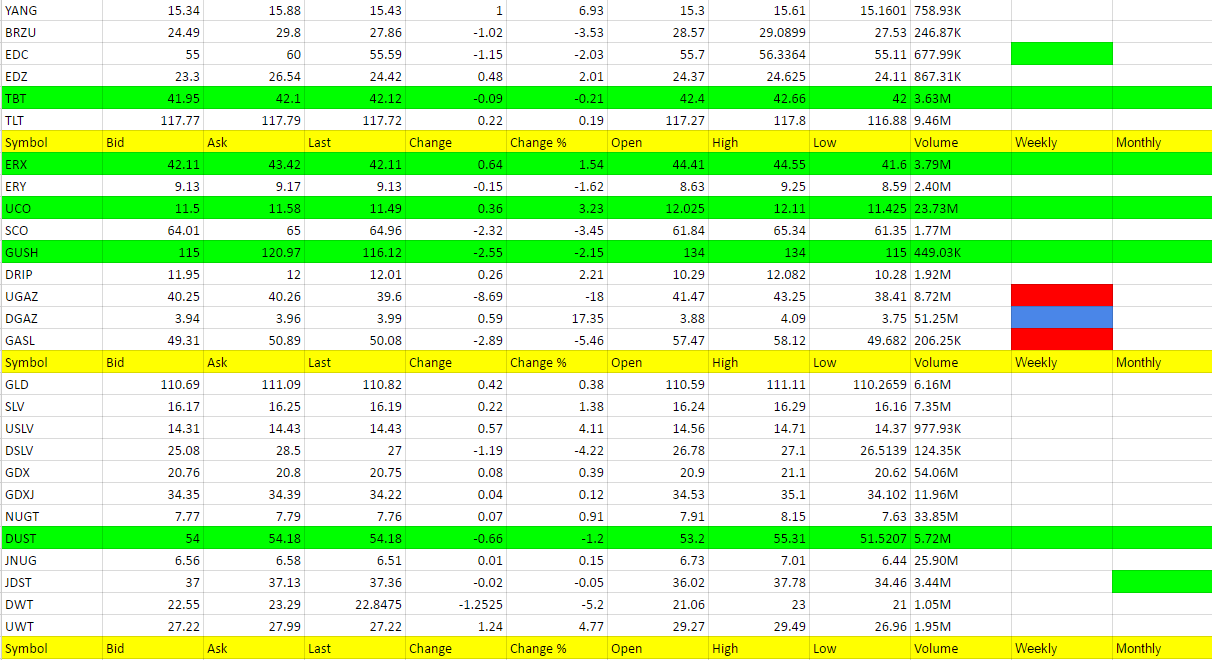

Energy

DWT and UWT have been added to the nightly report but keeping SCO and UCO on there since we are long SCO. once they have enough volume to replace the 2X ones SCO and UCO.

UGAZ has now turned red on the weekly. There will still be some volatility there but we’ll look for some longs in DGAZ for now which we did trade today. I know some of you look at the weather and make judgements on what UGAZ will do. Price action is all that matters and UGAZ had a very nice run that has ended for now. We’ll see what the trade will be with the rule that we don’t go long what is not positive for the day until the weekly goes green and we scalp only what is positive.

Precious Metals and Mining Stocks

Gold tried to get going today but had zero follow through. This weakness was confirmed when the dollar couldn’t break and stay below 101, but it did end the day there. With the dollar not getting us a break down it concerns me and technically JNUG did fall below 6 and move above 7 again, but only for a few minutes. With the Fed meeting coming up, it looks like the Fed may “talk” higher rates for 2017, and the market will at first believe them, and push gold and miners lower, but then will wake up soon thereafter and say; ” hey, we have been here before and the Fed was well off its target of 3 rate increases for 2016. Somehow I don’t trust the Fed.” I will want to be a buyer of any further dip in prices for at least a scalp, possibly a good scalp. Will this be the final smack down in gold if it comes? Possibly, but we will have to watch the dollar and make sure it doesn’t get too far above 102 and see if it can stay in the 101 or below after possible move higher right after Fed. We can’t let the dollar get out of control higher if the Fed is to be believed with what they say post the .25 increase.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.