Nightly report so you know how we played the market today. https://illusionsofwealth.com/etf-service-subscription/

Today’s Trades

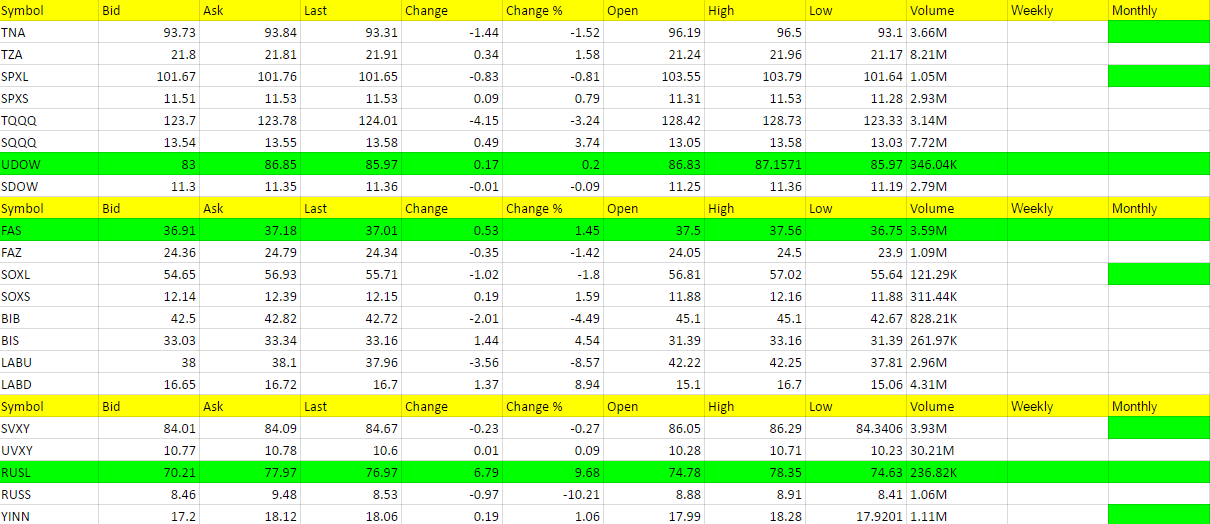

Started off the day on a bad note and immediately after calling it I even set up the trade lower that I thought would happen. Some of you waited on JNUG below 6.40 after the call at 6.7 and we got as low as 6.20 and after being stopped out got back in at 6.55. We then rode that to 7 and locked in some profit on 1/4 shares and bought back those shares again at 6.75. We are 6.68 after hours. Gold did go green showing some strength after being down overnight big and rallying and pulling back again. The dollar moved higher and spent the rest of the day falling helping the second long.

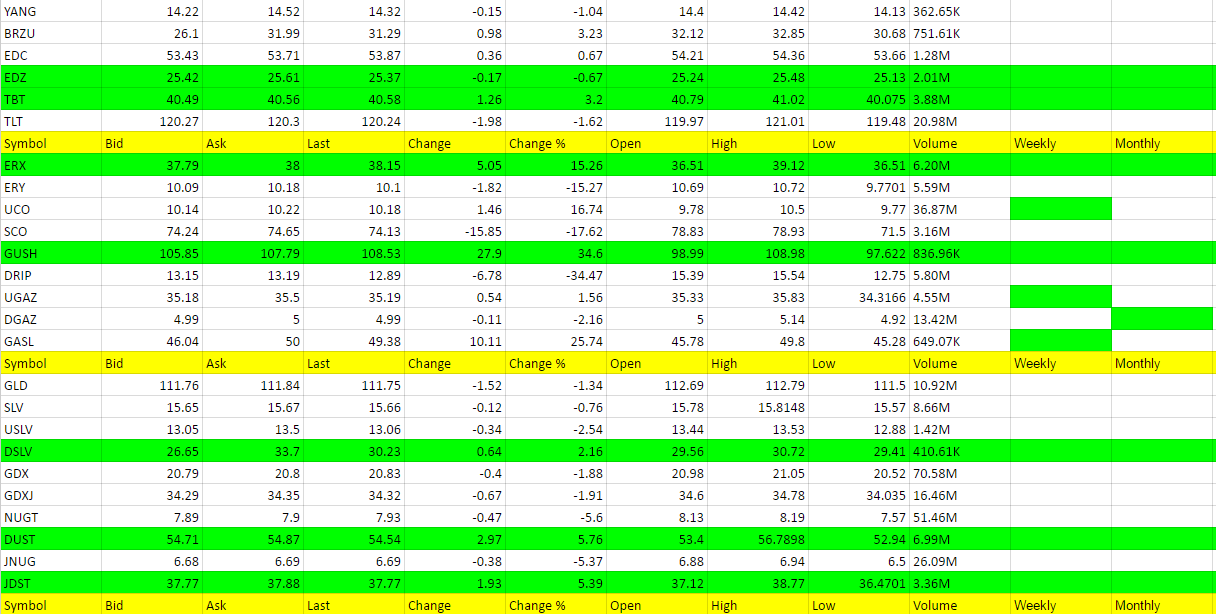

Meanwhile, we had a couple plays for scalp in DRIP, one of the new oil plays for us, with mixed results before finally hitting stride for a run from 11.89 to 12.18 and 12.38 where we sold shares and finally selling another 1/4 at 13 for a 9.33% gain. Still holding 1/4 position and last trade at 12.75. Not a bad run.

LABD and TZA are hanging in there if you played those. Didn’t like the move up in futures by the end of the day, but S&P and NASDAQ are going to lead the DOW lower I think. The DOW is just a little stubborn. When you see UDOW go red on the report below, that’s your sign to start that LABD, TZA and FAZ mutual fund.

We had a great run in UVXY from 11.02 to 11.74 where we took 1/4 profit for a little over 7%. We then sold 1/4 more on a move down to 11.50 and are trying to get more with the remaining shares. I’ts bidding 11.40 right now.

I admit yesterday was rough. It was rough for most traders unless you were the market makers doing the whipsawing. Those days you have to push through to get to days like today. My system overall works and my calls aren’t all perfect, but the goal is simply to keep stops on wrong calls and get in some that can move 7% or 9%. A few 2.5% losses are then forgotten about. And we move on. We don’t dwell. We stay positive. And we hopefully make trading fun.

Economic Data for Tomorrow

8:30 Nonfarm Payrolls

8:30 Unemployment Rate

1:00 U.S. Baker Hughes Oil Rig Count

Stock Market

I was impressed with the strength in the foreign markets data the last couple days. It does give the Euro a chance to move higher. If the dollar does pullback more, it should setup some great trades for us as money flows from what has been doing awesome in the market, to what has been beaten down. You know I have been leaning short the market, and I haven’t been calling go long certain ETFs on the sheet that are green on the weekly/monthly. I liked that others now are looking lower but we’re not breaking down until the DOW starts having some red days. We’ll see if that can happen soon.

Foreign Markets

No call at present.

Interest Rates

TBT is impressing me, but I think the party is over very soon. If have a month to trade something somewhat conservative, buy TLT under 119 here (118.79 ask now).

Energy

I am happy we added the new ETFs to trade oil with. Did will with DRIP today. Heck, anything that is down 40% in 2 days peaks my interest.

UGAZ was and is on fire but I’m afraid that after the better than expected report today I ignored it. Just like with Pokemon, I can’t catch em all (some of you older won’t understand that and no, I have never played the game, just know the lingo). I want to keep an eye on DGAZ.

Precious Metals and Mining Stocks

See above for metals. It’s still all about the dollar but liked what I saw today. Will the dollar bounce off of 101? don’t know. But I take profit when we shoot up so quickly to give us more time with the remaining shares to try and see if we can take off for the bigger gains. While I normally scalp, and should have the other day as I said, somehow I feel better and better about metals. I haven’t put them blue on the one to watch though. So there’s that.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.