Doug was interviewd by Brian Bain: in the interview they discussed the following

- $50,000 Seems outrageous but starts appearing saner in the context of John Exter’s inverse pyramid.

- Many things can trigger the unraveling, they all usually come back to Fed.

- Doug is confident Fed will not raise rates again this year.

- There will be a time when treasuries begin to crack, then gold and silver will begin to take off.

- When will $50,000 gold come?

Interview notes:

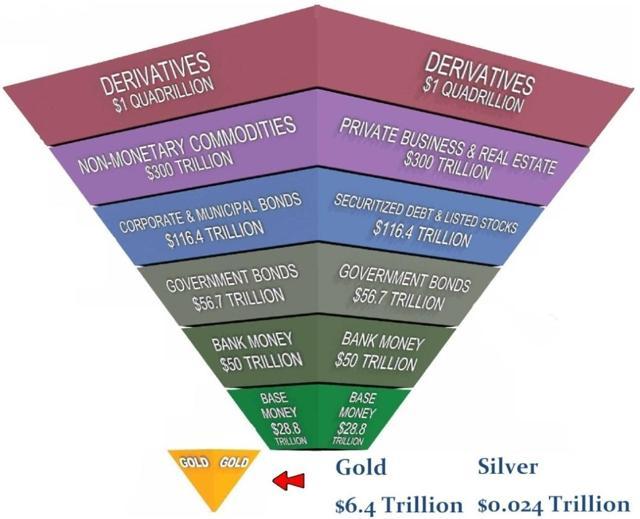

- $50,000 seems outrageous but starts appearing saner in the context of John Exter’s inverse pyramid.

- John Exter has been called “the only honest central banker”

- He was a central banker in the 1970s and known for his critique of central bankers

- He claimed Fed was out of control at when it’s debt load was around $80B

- “Gold bugs” still see cracks in the future of the federal reserve system, John Exter saw these cracks back in the 1970s

- Congress has no clue as to saving money or budgeting

- Central Bankers accommodate Congress with artificially low rates

- John Exter’s Inverse Pyramid

- Upside down pyramid with gold at the bottom

- 2008-09 we had a mini-crash in the pyramid, but gold and silver also got hit

- Once this unraveling begins, even gold can get hit

- Many things can trigger the unraveling, they all usually come back to Fed

- The unraveling begins when bids disappear on risk assets, investors trying to liquidate assets are unable to

- In 1987 there were some assets that had no bids

- Fear sets in and causes people to panic (ex: 1987)

- Fed will do all they can to stem

- Doug is confident Fed will not raise rates again this year

- Fed will likely begin speaking of QE again because the strong dollar is really hurting things

- Gold and silver should bottom where they are short-term

- Gold and silver will collapse with everything else

- During the predicted unraveling cash and treasuries will do best

- TLT and TMF will shoot up

- The dollar will go over 100 and even 120

- Doug is confident in gold and silver (SLV) now more than ever

- Even so, he sees one more last leg down in gold and silver

- Gold should run up to 1400-1500 over summer 2018

- There will be a time when treasuries begin to crack, then gold and silver will begin to take off

- When to buy gold? When you begin to see treasuries crack

- Can’t have a dollar crash without other currencies crashing

- Doug recommends going half in gold now and half in during the crash coming in September/October 2018

- When will $50,000 gold come?

- If Fed raises rates down the road, when is the end game? When we hit 6% in interest rates

- Fed still has a lot of tools, can still lower rates and even go negative. The US cannot pay 6% interest on its debt

- The coming deflationary credit contraction could extend longer than people think

- He sees us easily reaching $5,000 gold

- For summer 2018, Doug sees stocks and gold/silver going higher

- For fall 2018, Doug will be looking to see if the Fed starts retreating and potentially mentioning QE again. This could be the beginning of a 2007-09 type crash.

- Doug looks to be long metals and miners by end of year

You can find the interview via the following links:

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.