Last week there wasn’t much to say when gold is going up. We just enjoy the ride. Tonight you get a look at my ETF Trading Service again where we rode metals up last week, but sold out some and then jumped on the opposite side, then sold and jumped back in the long side. Was a great week overall, but the dollar is still your key for gold.

Friday’s Trades

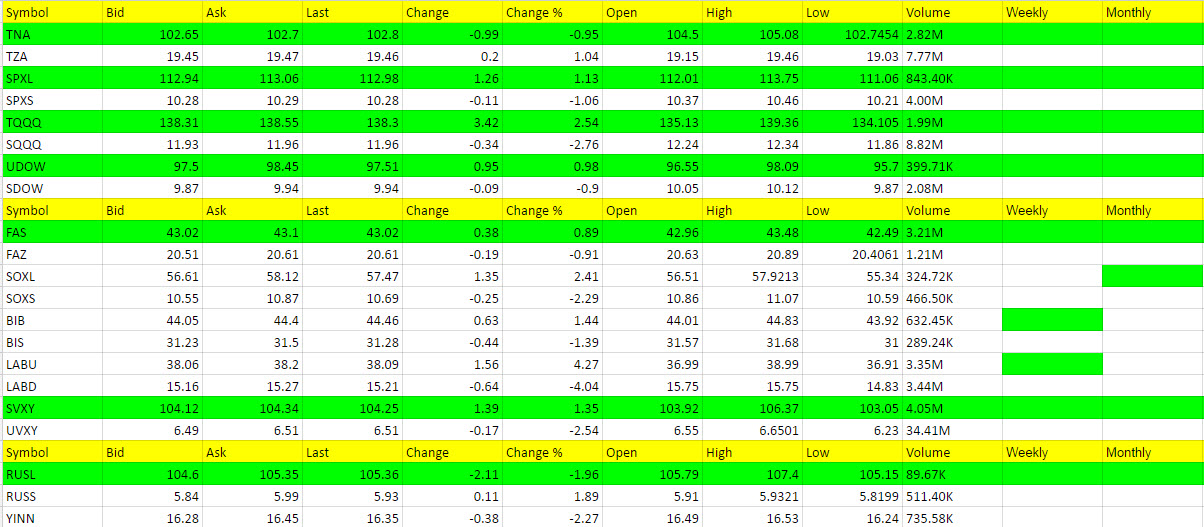

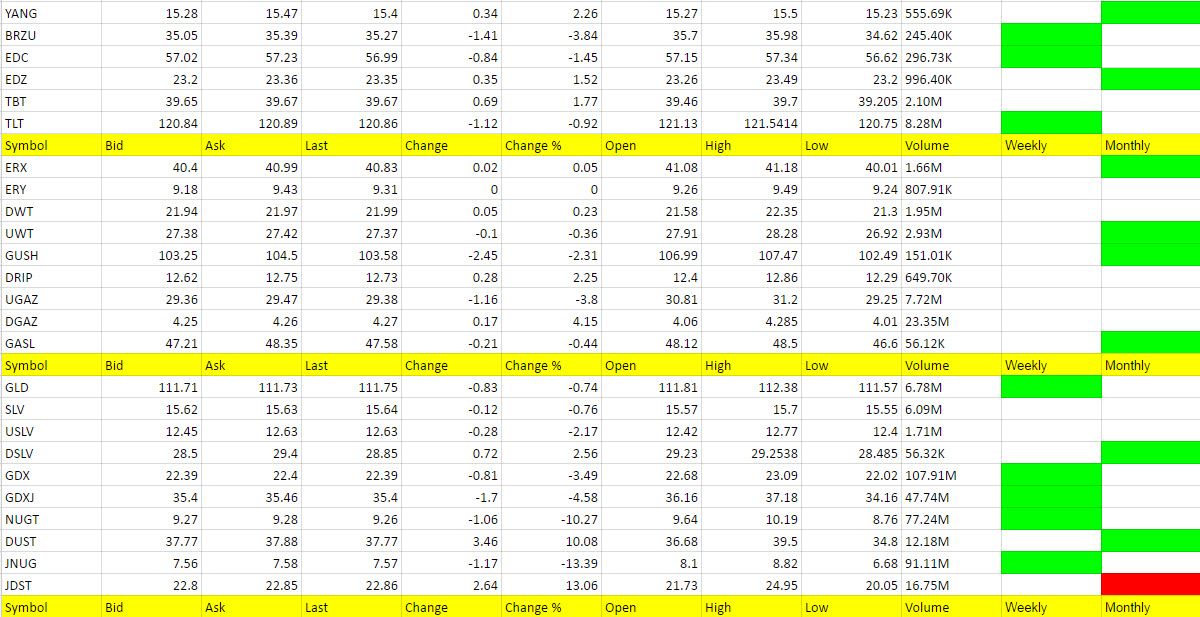

Friday started off with a late trade in JDST that we got stopped out of, but we weren’t afraid to go at it again and were rewarded with a nice 10% move. Then we jumped ship to JNUG and rote it close to 7%. Other trades for the green weekly (and monthly for some) did ok too, especially TQQQ. We are close to taking some profit and hopefully we can do that Monday with a big gap up. It looks that way so far with futures up 6.75. Let’s wait for that open and take half off of the long the market trades and see the DOW hit 20,000 at the same time and ride the rest of the shares higher with a trailing stop of 2.5%.

Gold is opening lower at 1172.30 with silver to 16.48 as the dollar is up over 102 again to 102.17. It’s hard to play JDST as a hedge when the markets aren’t open, but I know we can ride this out. If you keep a stop on Monday on JNUG, then do so. We are up a decent amount so hopefully no issues with a bigger fall.

Nat Gas is down a penny and oil down a nickel.

Remember, trading is all about taking profit and when it comes to leveraged ETFs, profit can come quickly and disappear quickly. Choose what makes you happy when taking profit and remember two things; you can always get back into the same ETF and treat it as a new trade with new stops, and pay attention to the nightly report and other data, and there is always another good trade around the corner.

I had a subscriber email me that he trades options based upon the nightly report. Thought I would pass along his results from Wednesday night’s report.

Economic Data for Tomorrow

No real market moving data tomorrow but 3 Fed members are speaking. China CPI tomorrow night.

http://www.investing.com/economic-calendar/

Stock Market

Stock market should hit 20,000 tomorrow. From there we will lean bullish still because our nightly report says to. FAS may be the key here. If it starts to falter, then it might bring the rest of the market down too, so keep an eye on it.

Foreign Markets

EDC disappointment so far. See what tomorrow brings to it. YANG keep in the back of your mind for now.

Interest Rates

If markets are to remain bullish, then we have to be more interested in TBT than TLT overall even though TLT is green on weekly.

Energy

No call in oil or Nat Gas right now. Too flat. Watch for choppiness.

Precious Metals and Mining Stocks

Metals on Friday followed a great day and gave most of it back before rebounding in the afternoon. I know a lot of you took profit on Thursday and got back in at a lower price with JNUG under 7. We’ll see what tomorrow brings, but watch the dollar for clues as usual.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.