Finally a nice day for gold and silver. Was it because the metals were oversold or was it just simply a reversal of pattern before the next leg down? For me it’s simply a reversal of pattern and once this reversal is finished we will test and break the lows moving towards that magic break of $1,000. This is the level market makers want to hit to break the back of gold bugs. It’s a psychological level that will indeed get many holding gold to wonder why they are doing so. But the fundamental reasons of allocating to gold haven’t changed. They were just delayed by unprecedented Federal Reserve action. There will be consequences to this even though it seems like the economy is just fine to many onlookers. It isn’t in my opinion.

Deflation

We are still deflating and the Fed will rev up their QE engines but this time I think the result will be different. This time I think that the faith many have in the Fed to keep the economy moving will come more into question. With that will be more fear. A break in gold price of $1,000 might get many to fear holding onto gold and silver, but it will be the first step towards bottoming and a real fear of Fed failure entering the picture if and when they implement QE to fight the continued deflation.

Scores

Gold and the miners scores improved to -75 while silver lagged with the score staying at -90. JDST got beat down hard Friday while JNUG, NUGT and GDX had fantastic days.

In Friday’s Gold and Silver Outlook I said to wait for the break of the highs in miners to jump in. If you did, you came out like a champ. JNUG for example finished 15.73% above it’s Thursday high to close at $4.34. I expect some continuation but move your stops up. Just look at the price action with JDST today to see how quickly the leveraged ETFs can turn. JDST is on the radar though. If I am right about the lower prices in gold ahead, it too will become attractive again.

LATE NOTES: 5pm PST, Gold down $8 and silver down 14 cents. Risk vs. reward says buy the dip, but with stops. Short trend is up until it isn’t.

UGAZ

UGAZ did give some back as expected. Plenty of time to get out of it with profit even if you held on Friday. Supposed to be a cold front coming in early so perhaps it might be good to buy on the dips. That was a nice winning trade. USO still on radar.

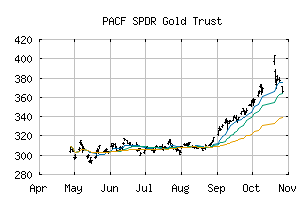

![]() The long term trend has been DOWN since Sep 11th, 2014 at 119.42

The long term trend has been DOWN since Sep 11th, 2014 at 119.42

![]() The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

![]() The short term trend has been UP since Nov 7th, 2014 at 112.71

The short term trend has been UP since Nov 7th, 2014 at 112.71

Based on a pre-defined weighted trend formula for chart analysis, GLD scored -75 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

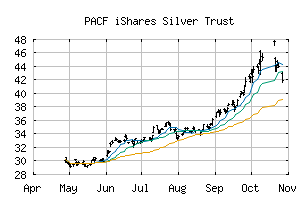

![]() The long term trend has been DOWN since Sep 11th, 2014 at 17.98

The long term trend has been DOWN since Sep 11th, 2014 at 17.98

![]() The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

![]() The short term trend has been DOWN since Oct 22nd, 2014 at 16.52

The short term trend has been DOWN since Oct 22nd, 2014 at 16.52

Based on a pre-defined weighted trend formula for chart analysis, slv scored -90 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

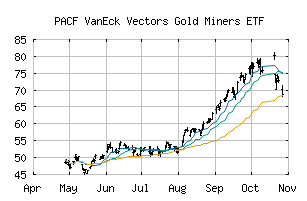

![]() The long term trend has been DOWN since Sep 25th, 2014 at 22.00

The long term trend has been DOWN since Sep 25th, 2014 at 22.00

![]() The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

![]() The short term trend has been UP since Nov 7th, 2014 at 17.82

The short term trend has been UP since Nov 7th, 2014 at 17.82

Based on a pre-defined weighted trend formula for chart analysis, gdx scored -75 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.