Precious Metals and Mining Stocks

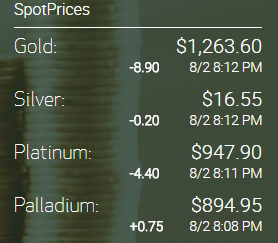

Gold getting pushed down a bit. Lots of times that happens right after the market closes for trading. The closer we get to $1,250, the more we will get long gold again. Only $13 away! Will try and manage the downside the best I can, and see if there are extensions lower to worry about. USD/JPY moving up not helping gold here either, but we are just setting up for a repeat move lower soon enough and gold moving higher. Markets don’t move in straight lines and at least we were able to switch sides for the short term pullback or at least sell higher and soon buy low for the traders out there. Swing traders I said will have to sit through some pain before the gain.

Notice how gold ignored the Nonfarm Employment miss data overall today? Dollar moved up end of day as well. The dollar moving up should put some pressure on gold short term, but we’ll take advantage of it with the JDST trades and EUO position we started. Regarding EUO and the dollar, take a look at these beautiful charts for it. The first is of the Euro topping and the other the dollar index at support. The Euro makes up a better than 50% portion of the dollar and if the dollar rises, it’s mostly because the Euro will fall. DSI (sentiment on the dollar) has been under 10 and just hit 10 on the way up today from 8. Euro sentiment by the way is 93. Way too many bulls there.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.