Below is today’s analysis for the ETF Trading Service I run over at IllusionsofWealth.com

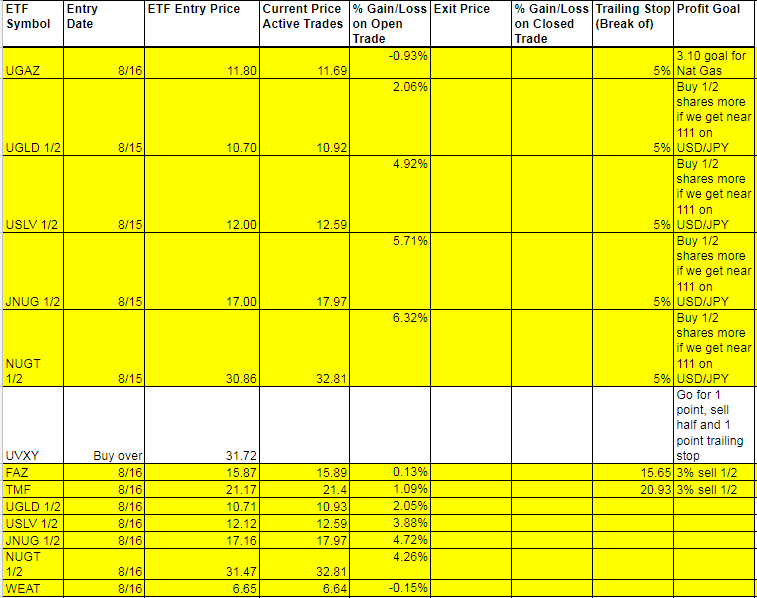

Today’s Trades and Current Positions (highlighted in yellow):

We were on the right side of metals and miners today. Some of you were locking in some good profit. Others just waiting for lift off. I think we are finally close. At least JNUG is over 18 again. USLV is what I really like. I see silver to 19 at some point here. See gold comments below.

Economic Data For Tomorrow

Tomorrow we have Initial jobless claims and Philly Fed Manufacturing Index as the market movers. Nat Gas storage at 10:30, and in the afternoon two FOMC members speaking.

http://www.investing.com/economic-calendar/

Energy

I wanted to trade DWT today but was too busy watching others. We totally missed the DRIP trade as a buy once it turned positive for the day at 26.07. Maybe one of you smart traders caught it.

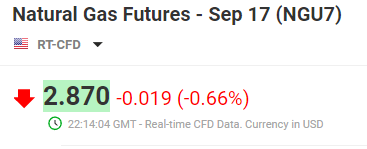

Nat Gas has disappointed, but first off we have already profited nicely from it. Second, we will have to wait this one out as we are still bottoming out in Nat Gas. 2.75 is the double bottom. That would be a stop out of 5% but we would not hesitate one bit to buy it right back as we head to 3.10 in Nat Gas. After hours it is a bit lower, bouncing around a little.

Precious Metals and Mining Stocks

If you read what I wrote yesterday on gold you can see that I had a lot of confidence I was trying to share and today we acted on that early by buying the second half or our shares in metals and miners. I see a move past that 1294 resistance next, then a move to 1310/1320 before a pullback. We should probably lighten up the load around those marks, but the only issue I have is taking a 10% profit when a 15% or more profit might be had. I know my rules state to take the 10% profit almost always, and we have already taken some profit from miners, but wouldn’t you agree that JNUG owes us some great profit? The answer is a resounding YES! lol So we’ll see how we do. There is always going to be a pullback and if you decide to take profit on your own, for half shares lets say, then you can always do that. A. there is a dip that will come at tome point that you can buy B. there are other ETFs that always trigger. But the good news is, I think we finally go green weekly on all these again and quite possibly green monthly on this current run. We’re not even green weekly yet!

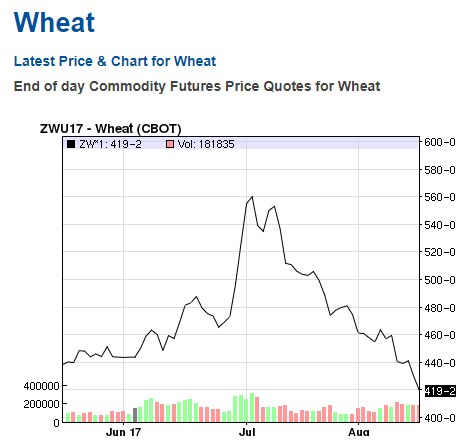

Yesterday I write the following about wheat, which we got long WEAT today for a swing trade.

WHEAT – Still have to wait on it. Just keeping an eye on it as the chart has more to go on the downside, despite any possible pushes higher from a micro level. Daily Sentiment (DSI) is down to 8. The closer we get to that green line, and the lower in sentiment, the more likely we are to profit from a risk versus reward perspective. From a report I follow; We estimate Managed Money net short 26,000 contracts of SRW Wheat. Big money still short.

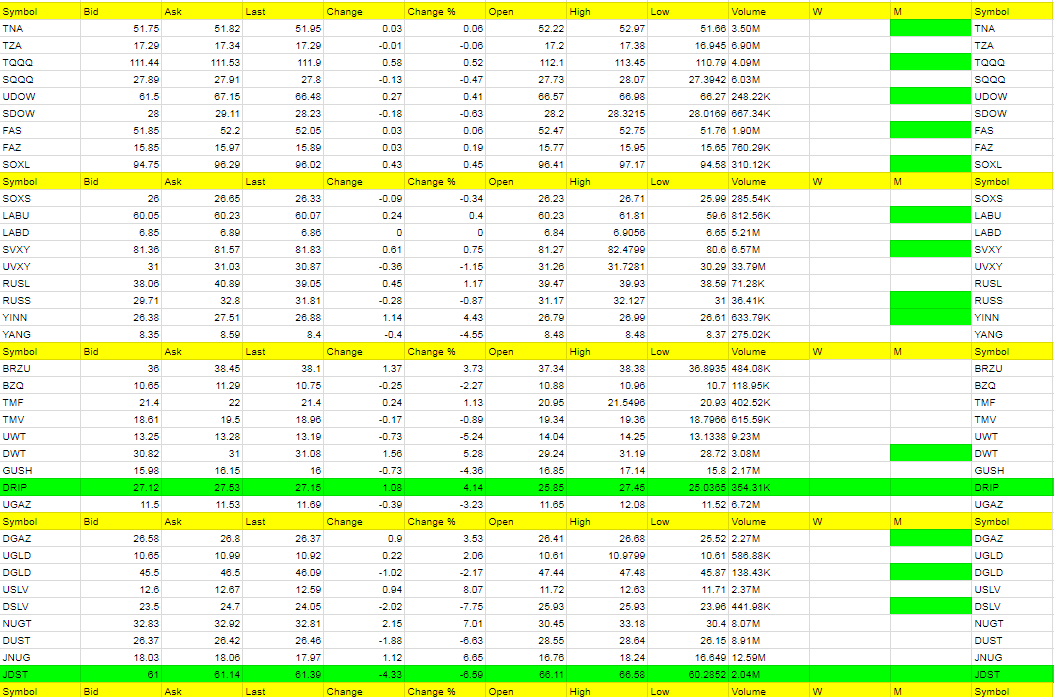

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

USLV, NUGT, JNUG, DWT, YINN, DRIP, BRZU. DGAZ

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DSLV, JDST, DUST, UWT, YANG, GUSH, UGAZ

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.