Tonight you get the market synopsis from the ETF Trading Service I run. It has a 2 week free trial for those who are interested. We profit in up or down markets following the Trading Rules.

Today’s Trades

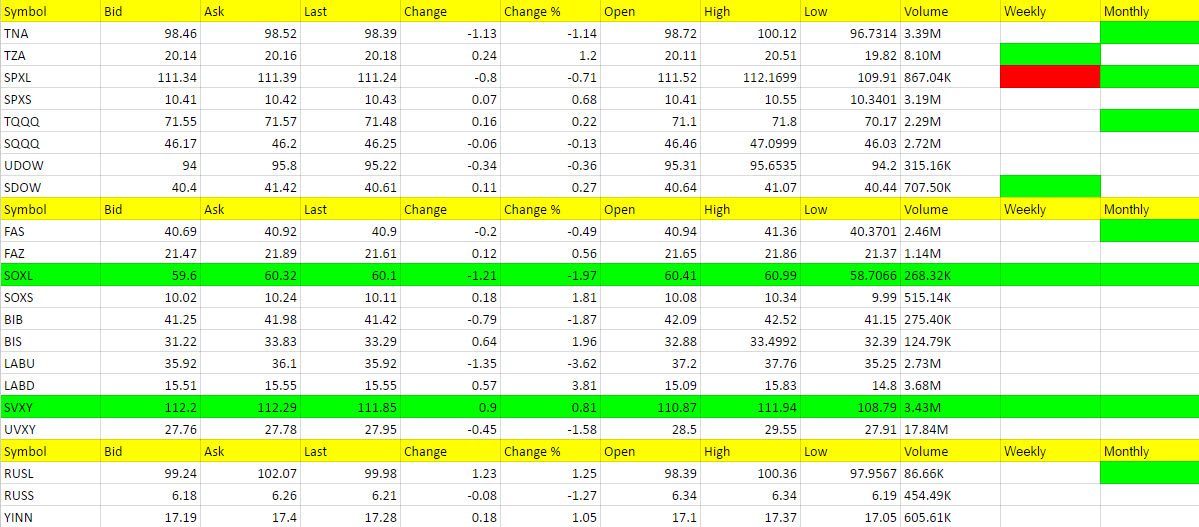

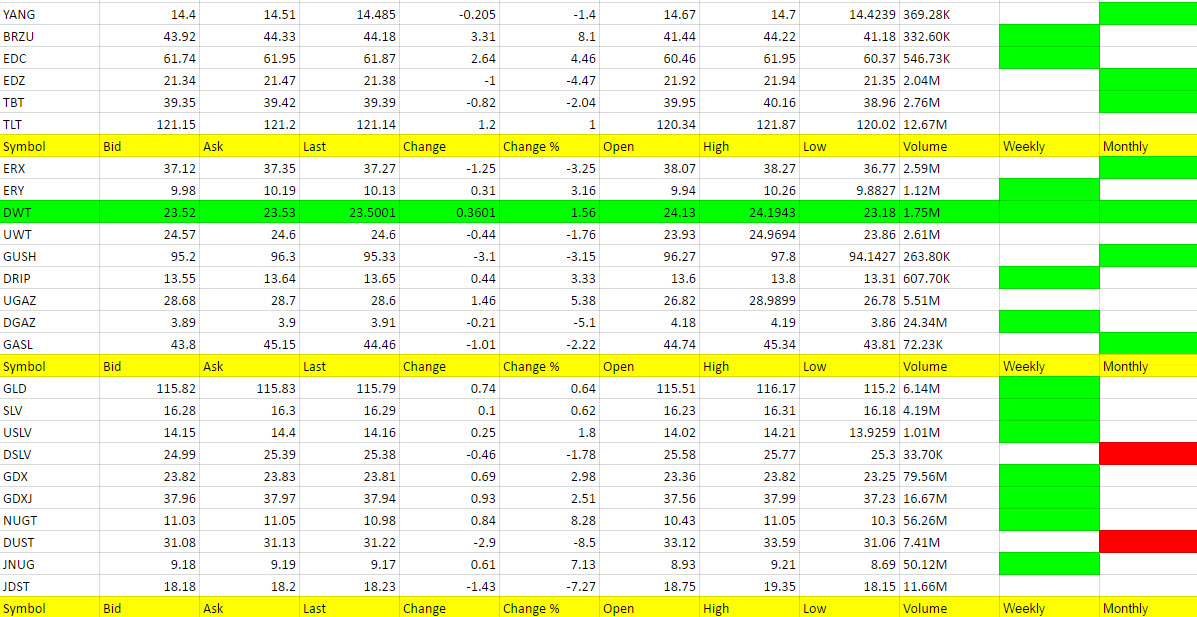

Today we got a little action early and caught some good trades. JNUG and JDST wasted our time most of the day as I tried a couple times to make JDST happen. The last one I got us out rather quickly though as there wasn’t enough time. After hours JNUG got up to 9.38 with the dollar moving below 100 on the index but is now 9.28. From our most recent entry at 8, after selling for profit and then trading JDST a few times for profit, it’s looking good.

I had said a couple days ago that I was leaning long gold because I thought President Trump would counter Yellen with a weaker dollar tweet that never came. However, today he sent his henchman Treasury Secretary Munchin to do the talking. http://www.zerohedge.com/news/2017-01-23/usd-dumps-after-treasury-sec-nominee-mnuchin-warns-excessively-strong-dollar

Jury is still out here as that 100 number is pretty powerful support and a little move through it isn’t necessarily an “all in” on the other side. We’ll know more by morning, but I like it when a plan comes somewhat together. I do expect it to continue.

UVXY was the best percentage move for us today and LABD did well for one trade. SDOW never got going with the reversal and DWT we got out with good profit from Friday and TLT too as we took the profit (I noticed the reversal was too strong and took the 1% – same with YANG which I got us out – .07 cents even though I prematurely called it a Swing on Friday. I think I called TLT a swing too. 1% on one out of 2 trades I’ll take 240 times a year if I call it a Swing and change my mind. Of course I have no idea if some of these turn out to give us 10% or more with good timing. Last time YANG got us 17% minimum. If I call some and change my mind, doesn’t mean I am right, but that I try to protect the downside. Not everyone can day trade these, I know, and am working on some Swing trade options but will take a bit longer to analyze. Thanks for your patience. I am doing what I can and am getting some good feedback from those taking profit.

For those of you with some time on your hands, I think this Investors Summit below can be beneficial. This will be the last time I post about it. I’m not big on promotion. Thank you.

I am part of 25 other Investors and Fund Managers who have put together a DIY Investment Summit that some of you may be interested in. I think the price is right for what you get (less than $100). I know I am personally throwing in free PDF copies of my Buy Gold and Silver Safely and Illusions of Wealth book but there is much more you can take a look at that I think can help you with your trading. Here’s the link and decide for yourself. https://diyinvestingsummit2017.com/homepage11194992?affiliate_id=571968

Economic Data for Tomorrow

Overnight we have German Manufacturing PMI and in the morning the important Existing Home Sales.

and of course whatever The Donald does. Best we keep the financial news channels and Twitter feed up and pay attention.

http://www.investing.com/economic-calendar/

Stock Market

Does a weaker dollar help the stock market? We have had a nice move up in the dollar and stocks together but we now have to see if the tide will shift. I have been leaning short and I truthfully don’t have a grasp on it quite yet which is why I am playing some UVXY. Something will come soon in a trend and we have to be patient for it. The move below 2258 in futures was great for us but then we moved right back over it again.

SPXL quickly turned red on the weekly. I should have said something about not liking it while leaning short the market yesterday. Sorry for that confusion for some of you.

Foreign Markets

Sorry to be wishy washy on China. I have some confidence in EDC now but not sure if China will join the fun or not so had to play a wait and see. Emerging markets can benefit from any U.S. downturn as money looks for opportunity.

Interest Rates

TLT we will see what the bonds do tomorrow with the secretary’s comments but took 1% from Friday after it fell back .50 from the high.

Energy

Didn’t play the DGAZ/UGAZ game today. Still liking DWT overall as it is green across the board. I wanted it to get under 23 again, but fell short so far. We’ll look for a long opportunity tomorrow, but that was a pretty decent pullback to 23.18 but fell a bit short of goal and bounced higher.

Precious Metals and Mining Stocks

Despite the Treasury secretary’s remarks, gold is struggling to get through $1,200 and dollar has to stay under 100 to get some kind of a move now. We are looking good and I think Trump will continue to hammer the dollar. It won’t be a straight line mind you.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.