From the Trading Desk

With US equities right around all-time highs and the USD challenging levels it hasn’t seen in nearly 15 years, gold remains… weak. The post-Trump victory euphoria that spurred a massive equity and commodity rally (in base and industrial metals, clearly not in gold) appears to finally be losing some steam though. Since election night in the US, gold has fallen from a high of $1,338 to its current level of $1,190, over a 10% drop. Physical coin and bar demand in North America has picked up as the market has trended south but the biggest gold ETF has shed over 2,000,000 ounces in that time period. After being battered lower in such a short period of time, I would expect for gold to move up from here. The market has already factored in a Fed rate hike in December so unless they keep the rate unchanged, it shouldn’t be a surprise that will rattle the precious metals. Near term resistance in gold is coming in at $1,200 while support is at the recent low of $1,170.

Yesterday I gave my analysis of what I saw with the markets and we had a good GDP report and Consumer Confidence report that trumped some of the trades, but we are back in all of them and didn’t miss much. Below is tonight’s report sent to subscribers of my ETF Trading Service. We’re seeing more red in the markets appear. Even CNBC today had a headline “Is the Trump Rally Over?” Lots of data coming out tomorrow but watch China in the next 48 hours. This report is for you, the loyal readers of my Current Thoughts and did not go out on the blog.

ETF Trading Research 11/29/2016

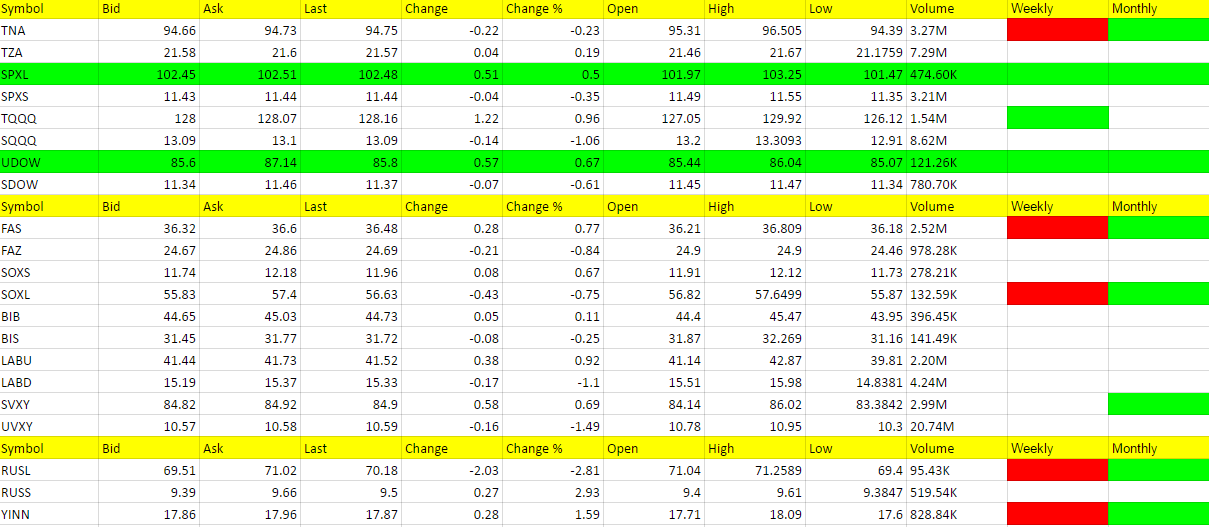

The first thing I want you to do tonight is look at tonight’s report and notice the ETFs turning red on the weekly. We use this as an opportunity to take a little risk and go short the market. I was a little pre-mature for risk takers last night with the GDP report coming out, and then the Consumer Confidence, but I am even more confident of a turn with the price action in futures we saw heading into the close. We didn’t break lower mind you, and that is why we only went 1/2 shares into FAZ, LABD and TZA, but I do think the Trump Rally is about to end.

LONG Trades and Update for the day

There is a slew of data coming out tomorrow which I alluded to in the alert sent out earlier today.

Here is what I wrote;

We have Draghi speaking at 7:30 PDT, ADP Nonfarm Employment at 8:15, Core PCE Price Index and Personal Spending at 8:30, Chicago PMI 9:45, Pending Home Sales and Crude Oil Inventories at 10:00 and a “Tentative” OPEC Meeting with 2 Fed members, Powell and Mester meeting and finally Beige book at 2pm. What could go wrong with a trade? (saying that sarcastically). And for the next day we have Chinese Manufacturing PMI then Germany, GBP and U.S. Manufacturing PMI giving us the real state of these economies.My view is negative overall right now and I think the data will start to show this.

Stock Market

We have a ton of data the next 2 days and I am leaning towards the fact that data isn’t going to matter much if we are in fact at the top of the Trump Rally. Today’s data might have paved the way towards that outlook and we’ll know more within 18 – 48 hours. I want nothing more than to add to a winning position in FAZ, TZA and LABD and you know the last 2 trading days I have been eyeing them. Well, their opposites for 2 of them FAS and TNA turned red on the weekly, so we’ll see what we get out of them. If you ever want to feel good about your negative point of view, head over to Zerohedge.com and you’ll almost always get the negative spin. But this time I kind of like what I see in their 2 of their latest headlines. Of course you’ll never learn anything from most of the commenters. I try to look at the data and verify. In my book Illusions of Wealth I addressed China’s liquidity issues. It’s something no one wants to address but issues there will spread here quickly. We just had to get through the Trump/Clinton distraction and its aftermath.

Weak Links In The “Trump Rally”

Chinese Bond Yields Jump Most In 10 Months On “Liquidity Fears”

Foreign Markets

Been ignoring them as they are not in sync together. Have to start looking at RUSS over 9.61 tomorrow and YANG over 14.69, assuming we get a move lower in the markets overall.

Interest Rates

Mentioned TLT as a buy at 121.70 and would wait for the GDP report. But with or without the GDP data I gave a call per above a little higher and we are long.

Energy

OPEC players this and OPEC players that. Even with what was said last night we don’t have a play in these until I come up with a good way to trade oil now that UWTI and DWTI will be disappearing. Hard to believe we don’t have leverage plays but someone will come out with something. I sure could.

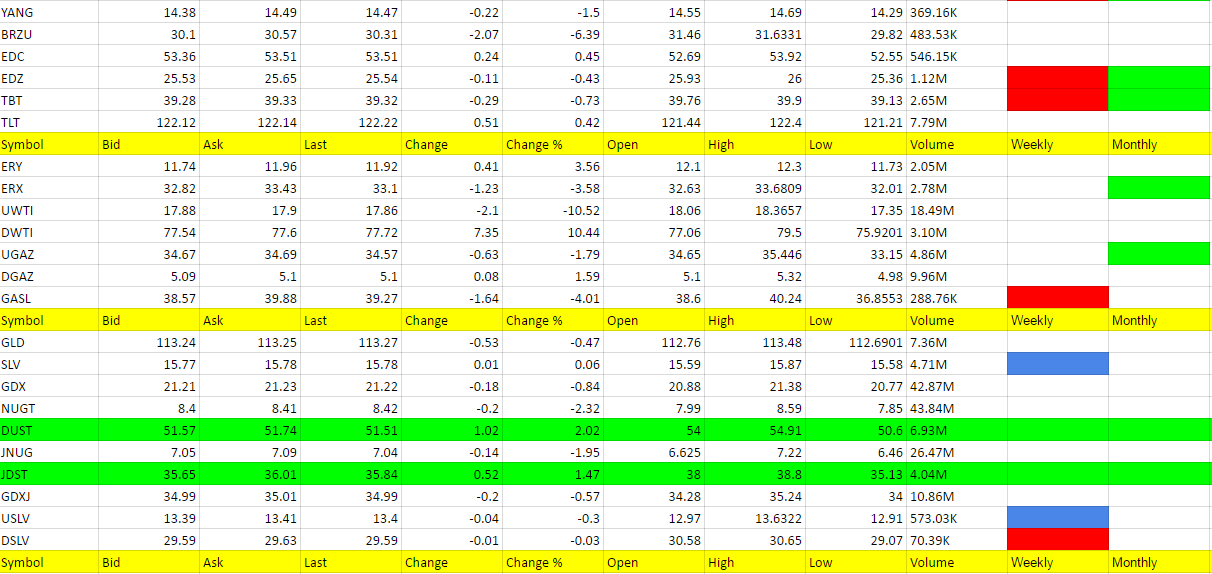

Yesterday I said UGAZ we would be out of and today it fell, rose and fell again with the second fall triggering DGAZ. DGAZ I would still scalp tomorrow or maybe we get a little run. But it has to prove itself to me first.

Precious Metals and Mining Stocks

Metals attractive with the pullback in the dollar. Just need gold over 1200 and dollar to cooperate. I did have a bullish sign possibly with DSLV going red on the weekly so I put USLV and SLV on the one’s to watch list for tomorrow.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.