Gold climbed higher on Friday and finally broke through the $1,200 resistance level and silver climbed higher as well. The mining stocks gapped up higher but like the price of gold, didn’t really gain momentum the rest of the day.

In Thursday’s report I said about UGAZ; “I’d be a buyer if it broke over $18.81 or a buyer of DGAZ now if it broke over $2.90, with stops of course.” We got within 1 cent of the buy for DGAZ and I would probably be a buyer of it Monday if we hit that price, with stops of course.

I might be a buyer of USO at $29.15 on Monday. We may have finally got the short term bottom in oil.

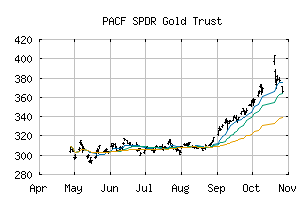

GLD

![]() The long term trend has been DOWN since Sep 11th, 2014 at 119.42

The long term trend has been DOWN since Sep 11th, 2014 at 119.42

![]() The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

![]() The short term trend has been UP since Nov 18th, 2014 at 114.72

The short term trend has been UP since Nov 18th, 2014 at 114.72

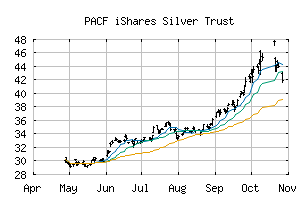

SLV

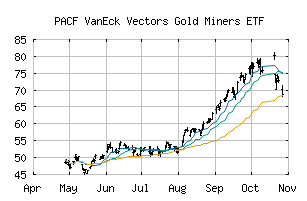

GDX

![]() The long term trend has been DOWN since Sep 11th, 2014 at 17.98

The long term trend has been DOWN since Sep 11th, 2014 at 17.98

![]() The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

![]() The short term trend has been UP since Nov 19th, 2014 at 15.72

The short term trend has been UP since Nov 19th, 2014 at 15.72

![]() The long term trend has been DOWN since Sep 25th, 2014 at 22.00

The long term trend has been DOWN since Sep 25th, 2014 at 22.00

![]() The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

![]() The short term trend has been UP since Nov 17th, 2014 at 19.18

The short term trend has been UP since Nov 17th, 2014 at 19.18

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.