Apologies again for not hitting the “Publish” button for the 11/13 report.

Friday gold, silver and the miners started the morning down but took on a life of their own. Gold finished up the day and from the bottom to the top gained over $40 while silver from bottom to the top over $1. Yet the miners couldn’t break Thursday’s high and the scores stayed the same. Will this momentum carry forward into Monday?

Asia Action

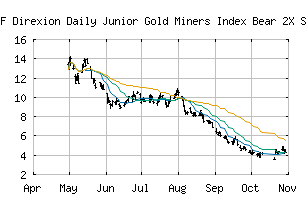

Well, Asia opened up lower so a “trader” has to make the educated guess of buying the dip and going long or playing the other side. It’s not an easy one to call but I still lean slightly bullish but the weekly green triangles keep me from being fully bullish. JDST still has all the green triangles as seen below. The trend is your friend but it can always reverse on a trader. Weekly triangles make for better swing trades and we have not yet seen that with the miners.

What to Look for this Week

This week we have the Fed minutes from the last meeting in October coming out on Thursday and some other economic data that always gives a trader a trade. But whatever the short term data brings, I still have a macro view of one more smack down. Expect it and trade accordingly. Buyers of physical still dollar cost average into a position.

TZA is struggling to find any strength to move higher so is not yet a play. UGAZ found a bottom and bounced but is still a volatile play.

USO still looking down.

Below are the highs and lows to look at for trades in GDX, NUGT, JNUG and JDST.

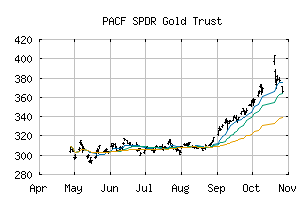

GLD

![]() The long term trend has been DOWN since Sep 11th, 2014 at 119.42

The long term trend has been DOWN since Sep 11th, 2014 at 119.42

![]() The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

The intermediate term trend has been DOWN since Oct 31st, 2014 at 114.94

![]() The short term trend has been DOWN since Nov 14th, 2014 at 110.87

The short term trend has been DOWN since Nov 14th, 2014 at 110.87

Based on a pre-defined weighted trend formula for chart analysis, GLD scored -90 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

![]()

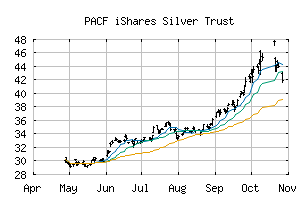

![]() The long term trend has been DOWN since Sep 11th, 2014 at 17.98

The long term trend has been DOWN since Sep 11th, 2014 at 17.98

![]() The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

The intermediate term trend has been DOWN since Jul 15th, 2014 at 19.93

![]() The short term trend has been DOWN since Nov 14th, 2014 at 14.87

The short term trend has been DOWN since Nov 14th, 2014 at 14.87

Based on a pre-defined weighted trend formula for chart analysis, slv scored -90 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

![]()

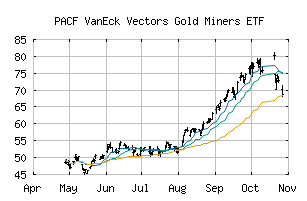

GDX

![]() The long term trend has been DOWN since Sep 25th, 2014 at 22.00

The long term trend has been DOWN since Sep 25th, 2014 at 22.00

![]() The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

The intermediate term trend has been DOWN since Sep 4th, 2014 at 25.62

![]() The short term trend has been DOWN since Nov 14th, 2014 at 17.73

The short term trend has been DOWN since Nov 14th, 2014 at 17.73

Based on a pre-defined weighted trend formula for chart analysis, gdx scored -70 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

![]()

JDST

![]() The long term trend has been UP since Oct 2nd, 2014 at 17.5900

The long term trend has been UP since Oct 2nd, 2014 at 17.5900

![]() The intermediate term trend has been UP since Aug 5th, 2014 at 12.0700

The intermediate term trend has been UP since Aug 5th, 2014 at 12.0700

![]() The short term trend has been UP since Nov 14th, 2014 at 27.6282

The short term trend has been UP since Nov 14th, 2014 at 27.6282

Based on a pre-defined weighted trend formula for chart analysis, jdst scored +80 on a scale from -100 (strong downtrend) to +100 (strong uptrend).

![]()

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.