Free Sample of the ETF Trading Service we offer. Each week we give out trades you can profit from. This week UWTI has got us over 8% of profit on half shares and over 11% on the remaining shares of the trade. You can sign up for the service with a 2 week free trial by going here: ETF Trading Service

Below is an example of what you’ll receive before each trading day. Alerts are sent live to your email when they trigger. Come profit with us!

Today’s Trade Alert

There were no new Trade Alerts today. Fed minutes were released and of course the market believes anything the Fed says and reacted positively to the “talk.” Nonsense. Futures moved from a nice down from the open, higher the rest of the day.

Trade Alert Updates

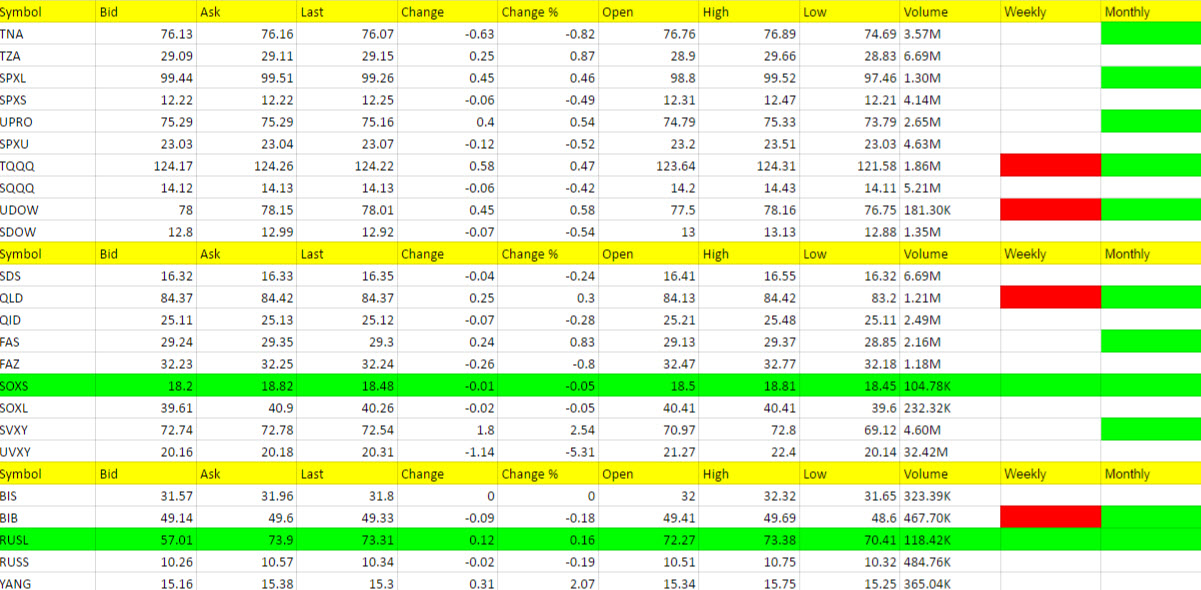

U.S. Stock Market

Yesterday I said we are very close to shorting the market but with the Fed minutes coming out I was hesitant to make any calls. FAZ (blue) was lower today and we’re just not ready to do this trade yet. I made a mistake and said SPXL and meant SPXS as a potential on the report yesterday. Hopefully you saw the report and knew what I meant. You’ll notice more red on the report below, but those hit before the Fed minutes were released, meaning we were establishing the trend but it was put on hold.

Call: No call at present. Patience will be rewarded.

Foreign Stock Market

YINN and RUSL still green but BRZU and EDC turned red. I needed these to start turning and we should get some good mileage out of them when the opposites are called.

No call at present.

Interest Rates

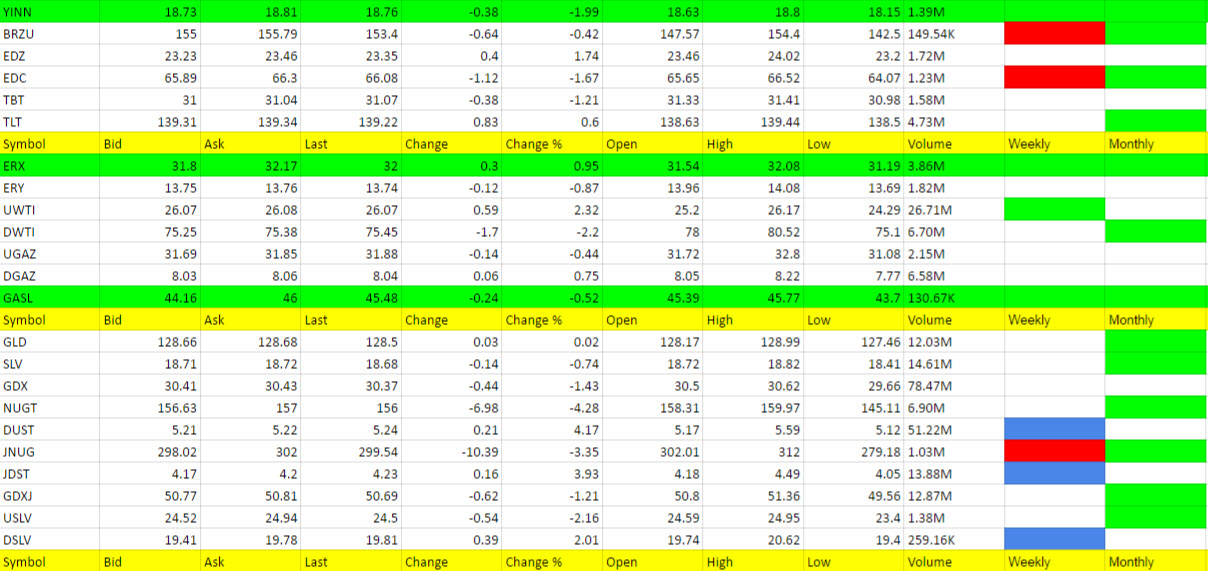

TLT bounced higher and is an every other day green, but no call with it churning like this. Of course I still like it longer term.

Energy

UWTI is a hold for more profit with stops in place.

DGAZ and UGAZ no call. Natural gas report tomorrow may trigger something.

ERX I still like but just too slow. Stay the course if in it, moving stops up.

Precious Metals Market

DUST I had been attracted to and now like JDST and DSLV. No call as of yet but aggressive traders can buy any of these on a break of the high of the day for each (if not already in DUST this morning).

Other Calls

As I said yesterday, from time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.