The price of silver has been steadily falling since April of 2011. Yet the U.S. Mint is having trouble keeping up with demand for One Ounce American Silver Eagles, as gold dealers tell their customers they will have to wait a week to a week and a half for delivery, and junk bags of the 90% silver coins (the silver coins in use before 1965) are harder and harder to come by. Even with this decline in prices, ETFs like iShares SLV are showing a pent up demand for silver that doesn’t seem to want to end despite lower prices.

- March 25: 343,645,323.100

- March 11th: 342.292.222,100 ounces

- March 1st: 342.433.205,000 ounces

- Feb 8th: 335,858,876.200 ounces

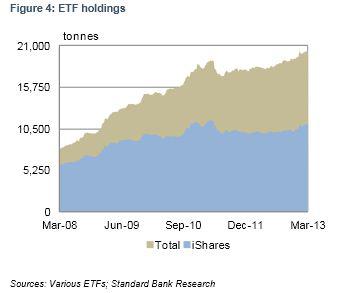

The following chart shows overall increase in ETF silver demand has risen the last few years.

While it is easy for those who own silver represented by ETFs to sell with the stroke of a key, why aren’t they selling? Perhaps the answer can be found in the mindset of the ones who buy physical gold and silver as many of them own ETFs as well.

People who buy physical silver aren’t calling and selling their coins. Why is this? Why do those who buy physical metals not sell when the price drops? We will look at two of the most popular products, One Ounce American Silver Eagles and the 90% “junk” silver bags and try and answer that question.

Continue reading at SeekingAlpha.com where I write exclusive articles from time to time by clicking here: http://bit.ly/15WoeLA

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.