What a day for gold and especially gold mining stocks! We can thank the incompetent Fed for this as the dollar fell hard today and precious metals shot higher. Below you will find my professional analysis of today’s events with an expectation of a bottom being in for now with gold, silver and mining stocks. But we are not out of the woods yet.

Tonight’s ETF Trading Research from Illusions of Wealth that many are benefiting from the calls being made daily; https://illusionsofwealth.com/etf-trading-service-live/

Today’s Trades

The Good

JNUG, USLV, DWT, TLT

The Bad and The Ugly?

Who cares? Did you see JNUG today? lol

Sorry, but sometimes you just have to feel good when things come together and today was one of those days and then some.

Today we got that perfect storm after the Fed of the dollar falling, gold and silver rising from the ashes and JNUG taking off to over 30% on the day. I said yesterday that I wanted us in JNUG heading into the Fed and got us in early but also we hedged with some JDST so still came out pretty good overall. Some of you though waited till today and bought or bought yesterday at 6.20/6.30 range. Either way, a nice pop higher. I know some of you wrote me and said you did quite well. I think this might be just the beginning though for metals, so we’ll see. Silver and gold both are up in Asian trading.

We carried over DWT from yesterday at 17.22 and sold premarket at 18.36 and 18.18. Got back long again at 18.40 or better and up presently.

Also still carrying TLT from 116.86.

I did have us sell early the 4 two day old green ETFs and was simply surprised the markets did so well after the Fed. They are just 1% higher so I won’t feel bad if they begin to tank and I did have us go long FAZ because financials are weak and SDOW as I think financials will lead markets lower very soon. For me, financials weak and TLT strong shows what will happen next so this is why I have us positioned this way.

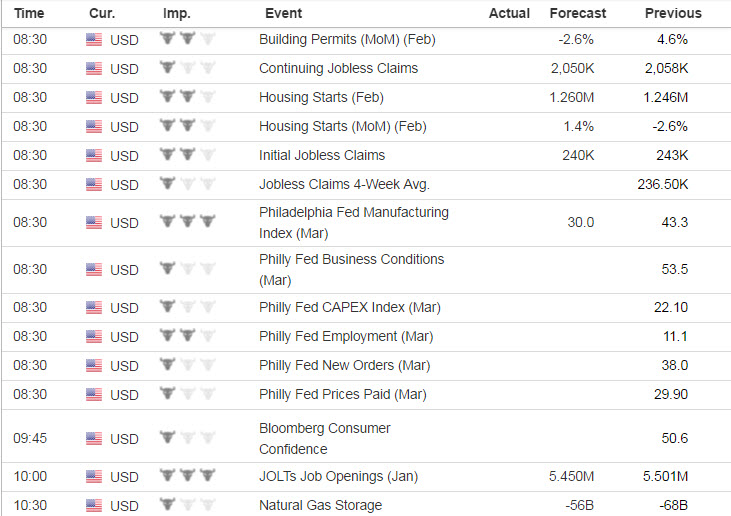

Economic Data for Tomorrow

Philly Fed and Jolt’s Job Opening along with Nat Gas report tomorrow.

http://www.investing.com/economic-calendar/

Stock Market

Very surprising on today’s market move higher after the Fed, especially after Yellen’s reply to the reporter about GDP. I took a snapshot of that for future reference. Perhaps some of you bright folks can explain “noisy indicator” to me? lol For those that don’t know, I have been challenging the reasoning for raising rates when GDP has been falling. Now we know to the Fed, GDP falling is just “noise.” This could be the beginning of the end of the Fed.

Foreign Markets

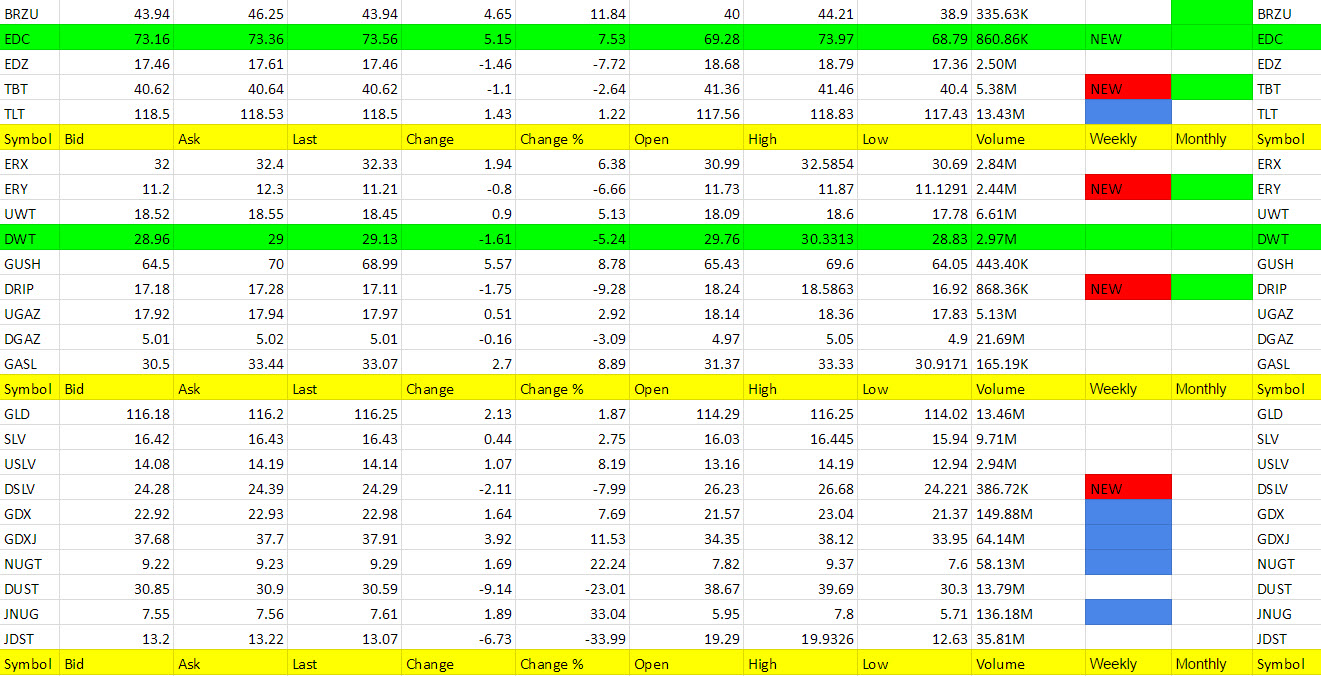

Foreign markets up with the U.S. markets and EDC was the first to turn green on the weekly and a buy tomorrow at the open.

Interest Rates

TLT is of more interest to us now with TBT turning red. We may have caught close to the bottom with our buy at 116.86 this week.

Energy

Still benefiting from some good early trades long oil. We’ll continue and maybe catch a green weekly signal before any pullback.

No call on Nat Gas till after the report tomorrow.

Precious Metals and Mining Stocks

We’ll take a day like today anytime. And we did this without us being green on the weekly. Just wonderful.

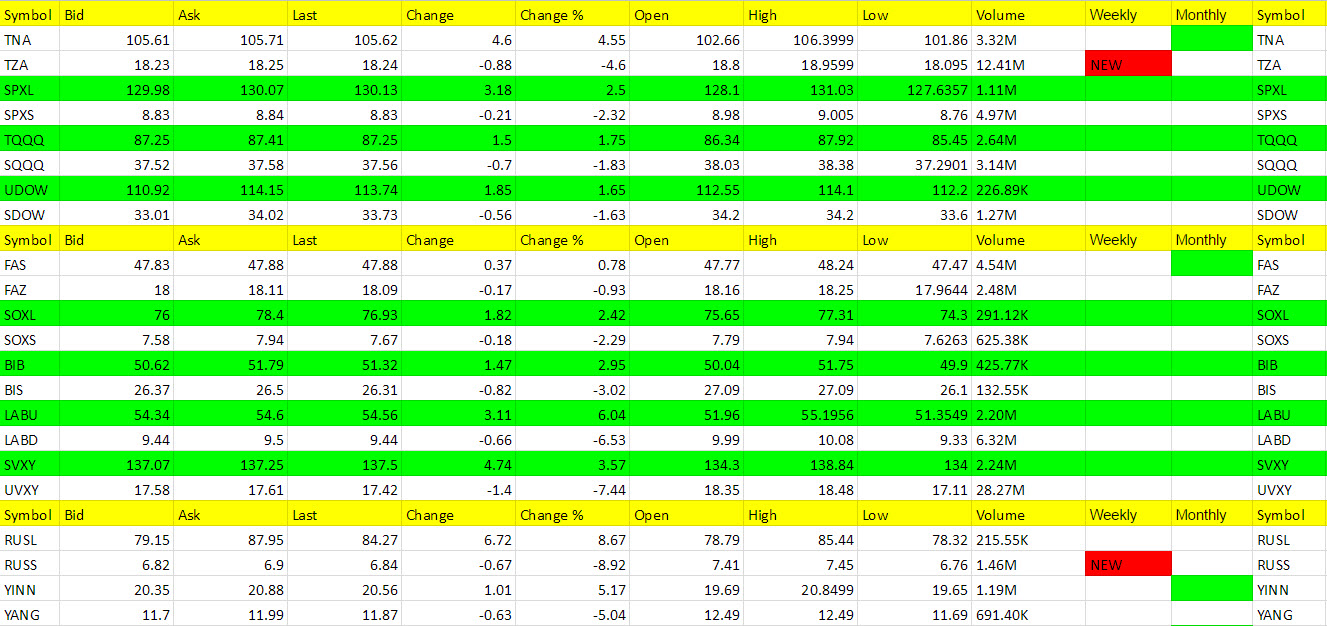

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JNUG, NUGT, BRZU, GDZJ, RUSL, GASL, GUSH, USLV, EDC, GDX, ERX, LABU, YINN, UWT,. TNA, SVXY, BIB (EDC turned green on the weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JDST, DUST, DRIP, RUSS, DSLV, EDZ, UVXY, LABD, ERY, DWT, YANG, TZA, BIS (TZA, ERY, DRIP, RUSS, DSLV, TBT all turned red on the weekly)

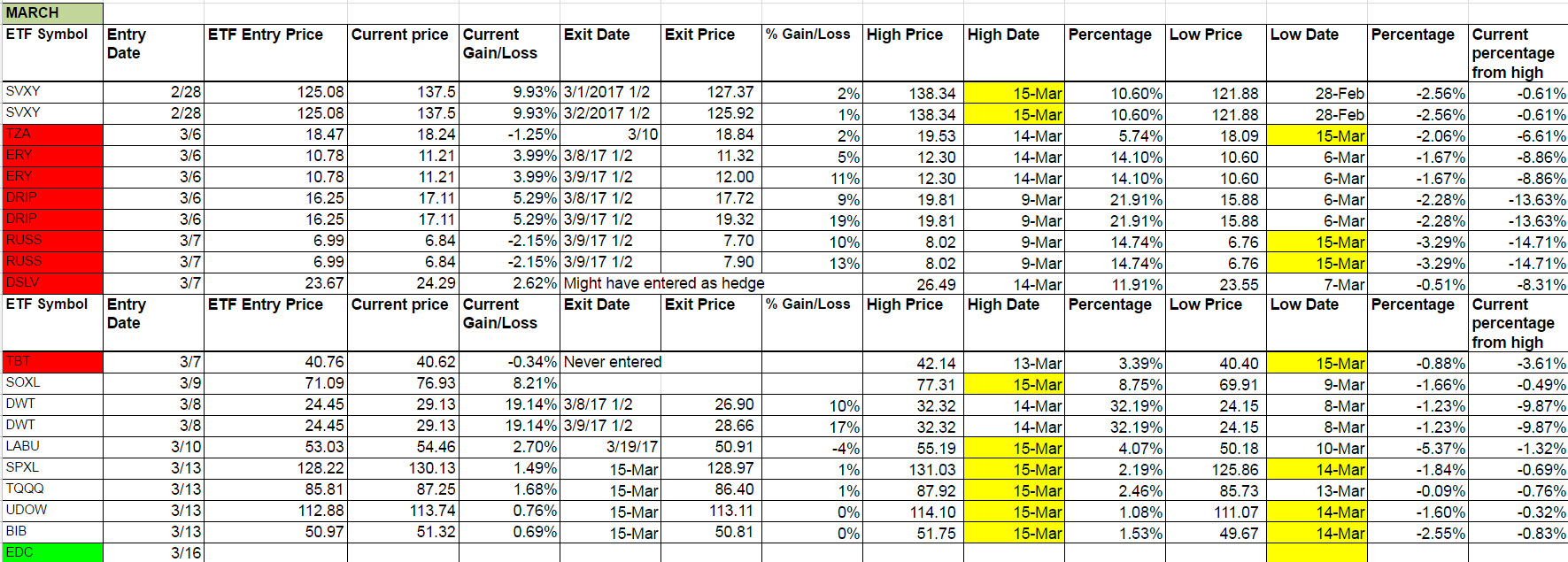

Green Weekly’s

EDC is the new green on the weekly. Notice also that the last column and the “Current percentage change from high” as to how much these fall from grace and why we always keep stops even if green on the weekly. Many hit new lows today. But notice just yesterday, TZA and ERY along with DSLV had a new high? Then glance over to the Exit price and % gain on some of them. We were out with good profit already.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.