Today you get a free sample of the ETF Trading Service report I just wrote which recaps our trades on Friday and sets us up for trading on Monday. It also talks about the precious metals market in-depth. Enjoy! and if you are interested in profiting in up and down markets, you can sign up for a 2 week free trial and see how we do for ourselves by following the Trading Rules. Go here to check us out: https://illusionsofwealth.com/etf-service-subscription/

Friday’s Trades

We bought half shares JDST 5 minutes to the close on Thursday. It was a mistake but I did tell traders earlier to go golfing and many took afternoon off and didn’t trade :-)) Got out this morning – 50 cents. Bought some JNUG but put out a warning what I thought might happen. It did as we pulled back quickly. Small loss in JNUG and switched to JDST @ 13. Scalped 50 cents at 13.50, the top. Fell back but not below 13. Bought back half shares at 13.30 with a target sell of half @ 13.75. Hit it. Told anyone who had not sold to sell half at 14.22. Took half home.

Economic Data for Tomorrow

Monday’s are usually pretty slow data days but we have Core Durable Goods Orders at 8:30 and Pending Home Sales at 10:00 as important data.

http://www.investing.com/economic-calendar/

Stock Market

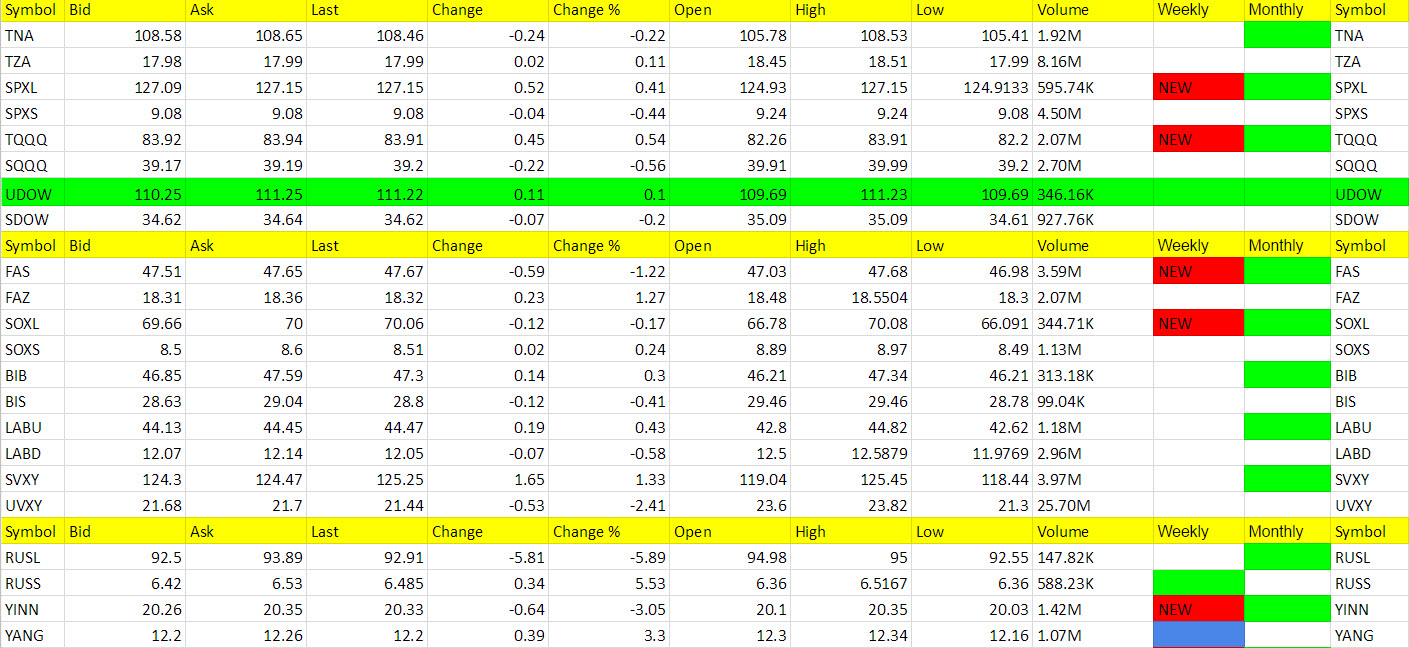

Thursday night’s report I said the following; “Every pullback we have seen so far has been bought and this has been a good pattern to trade, but with the additional red signals we are getting, a pullback can be right around the corner here so we should tread a little more lightly on the long the market ETFs.” After analyzing the data the pullback did trigger shorts on that move but the market rebounded right back up again once President Trump started speaking at CPAC. I’m not ready to call a mutual fund with short the market ETFs just yet and even though I said I might, we still are somewhat bullish but now getting those first signals of weakness and I might call some short the market trades tomorrow that can become holds longer IF we get the downturn continuation from Friday. No reason to be biased here. Let the price action dictate our trades. The more I dig into making this service the more I hammer that home in my brain.

Foreign Markets

RUSS started to take off for us and YINN and EDC turned red on the weekly so YANG, which we are already in and EDZ, should turn green on the weekly soon. I like these 3 and separate them because they all seem to move in unison.

Interest Rates

TLT is possibly taking off here, but it would help with a down market.

Energy

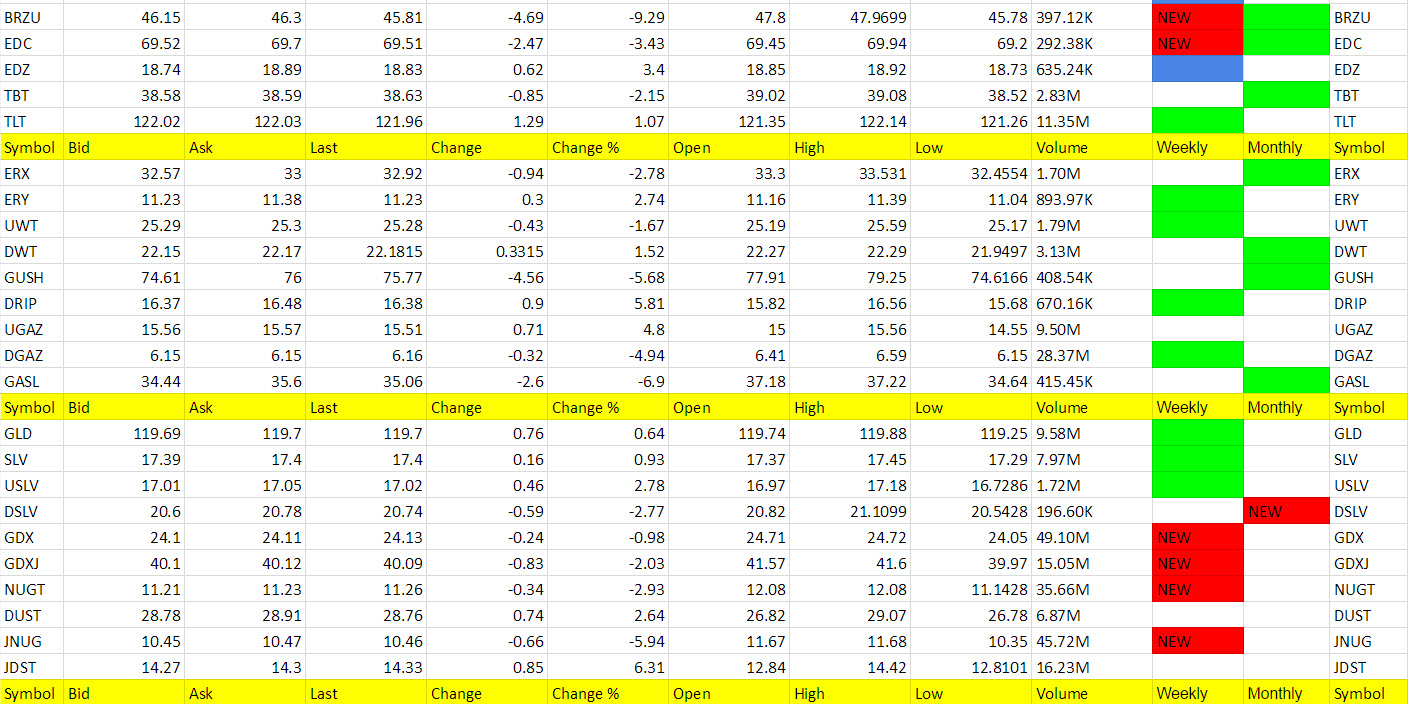

Tomorrow DGAZ may become a trade because it has been down more than 3% 2 days in a row. Rarely do we get 3 in a row so we’ll keep an eye on it. No call on oil at present as we are getting conflicting price action with the nightly report.

Precious Metals and Mining Stocks

Gold was down with the China open but now up 1.10 and silver up 5 cents. The dollar is down 3 cents to 101.09. We still need to pay attention to the dollar I think more for miners than we do gold and silver it seems. They are still trading inverse of each other. With 1/2 shares in JDST and sitting on good profit and with the miners turning red, I’m comfortable with that risk right now.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, RUSS, DRIP, UGAZ, EDZ, YANG

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

BRZU, GASL, RUSL, GUSH, JNUG, DGAZ, EDC, YINN (GDX, GDXJ, NUGT, JNUG, SOXL, SPXL, TQQQ, FAS, YINN, BRZU, EDC turned red on the weekly and DSLV on the monthly turned red) We should watch for a possible bounce in DGAZ tomorrow as it has been down more than 3% 2 days in a row.

Green Weekly’s

No new Green Weekly’s, but many red weekly’s.

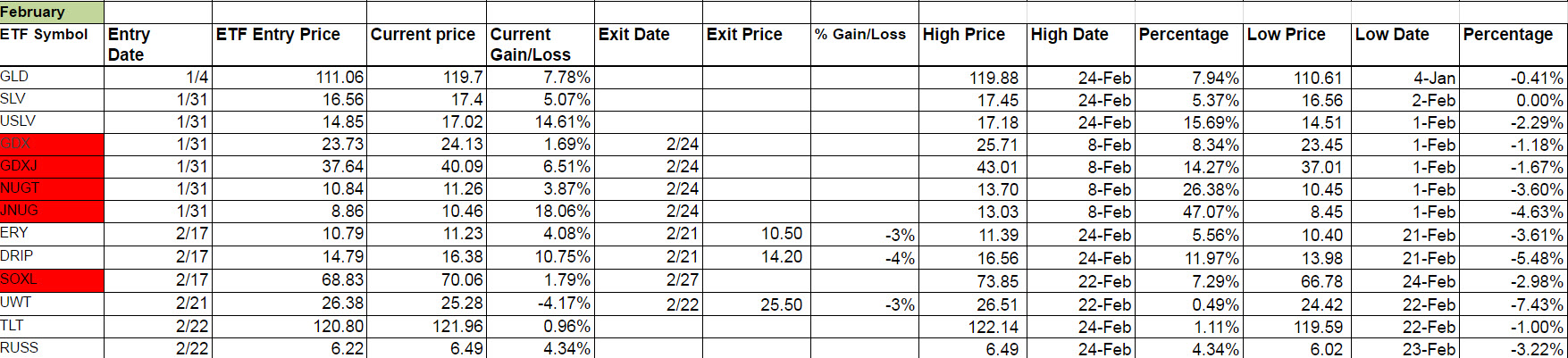

Since the following sheet is still a work in progress, first off I am adding any new green ETFs to the sheet below. Second, it is a guideline to entries when we first turn green. 3rd, we will move in and out of these, with our profit goals and stops from the Trading Rules. 4th, technically when I got us out of JNUG on Friday, I am using that price for the exit but can’t possibly use the current price of GDX, GDXJ and NUGT at that time as I was busy making calls. However, if we are in range of the closing price it’s not that huge of a difference as you’ll notice if you followed the rules specifically for these other ones and used a trailing stop, you would have been out sometime shortly after Feb. 8th at the highs. We don’t sit and wait in a trade and ride it back lower till it goes red. I hope that is clear and if not, reach out to me.

SOXL you would not have know triggered red so it is, according to how I have the rules set up, a sell at the open in the morning. Also, the same would have been true for all the others that turned red on the weekly but I wasn’t following them perfectly with the news system yet. From this point forward, we should be good.

I will make one other point though. Silver I can’t necessarily treat the same as the miners from now on but will have to begin to speak of it separately as it keeps hitting new highs and wouldn’t have been a sell on Friday. You can see though, at the highs, this was a great run for miners and I think we’ll be right back at it soon enough.

Lastly, JDST which we are in 1/2 shares is NOT green on the weekly and neither is YANG which we are in early, and I won’t record entry until they prove themselves more. We’ll try to ride them as long as we can and maybe they trigger green for us, especially YANG because RUSS led the way. I imagine EDZ will soon too now that EDC has turned red.

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.