Below you will find another sneak peak at my ETF Trading Service. I will be going public with it tomorrow.

Today’s Trade Alert and Trade Updates

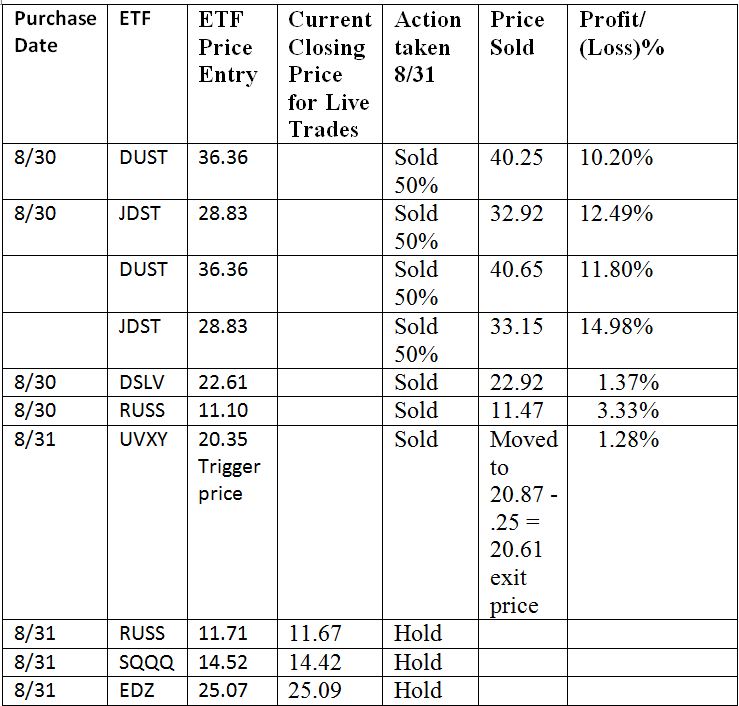

Below you will find the updates for the trades closed from yesterday, the new round trip trade in UVXY and 3 additional trades.

The stops on the new trades are:

RUSS 11.48

SQQQ 14.37

EDZ 24.59

The Power of the Trend

There is another way that you can trade these weekly and monthly green ETFs and that is hold them until they turn red on the weekly. Meaning, that once an ETF turns green on the monthly after already having turned green on the weekly, you can hold onto it, through thick and thin, until it turns red on the weekly. Just know that eventually it will turn red on the weekly and you’ll still have nice profit, but you will have given a chunk of that profit back waiting for the signal to sell. How I try to bring value to the service is to time the trades a bit, allowing for you to lock in profit, and then get back into the trade which we have done well with DUST and JDST taking some good, over 10% profits each time.

Stock Market

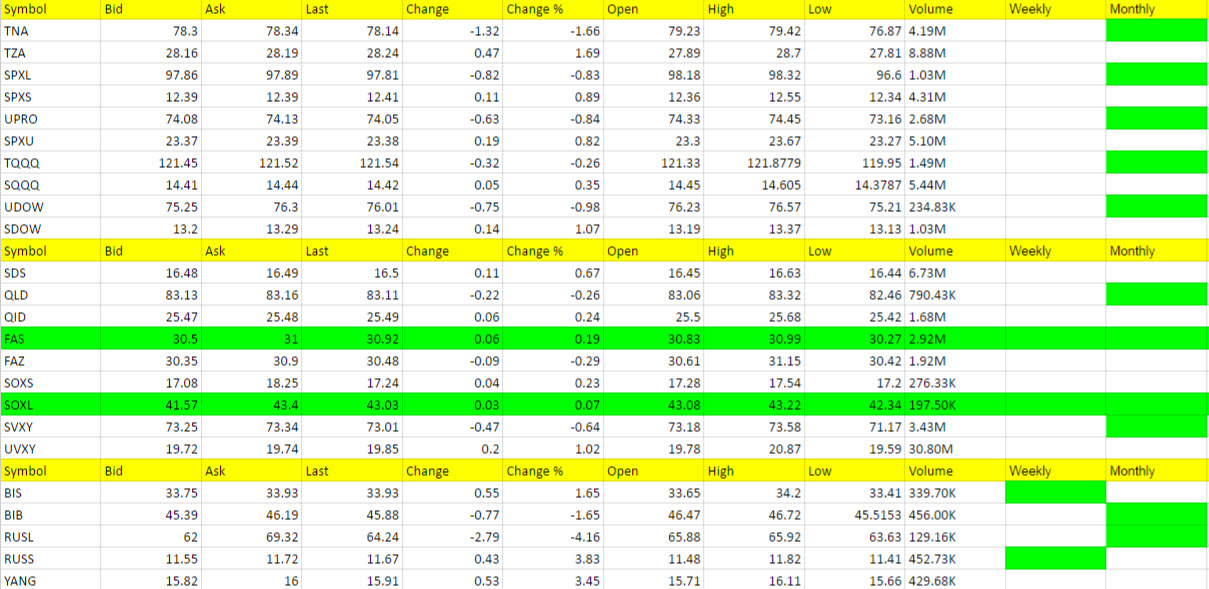

Yesterday I said I expect more short the market ETFs to trigger this week and we had a few today. QID also triggered but it is a slow mover so I did not send it out. I follow the 47 ETFs to get the general feel for the market but my calls for for those ETFs you can profit from the quickest, meaning they will earn you a higher percentage profit faster than some of the others.

Yesterday I also posed the question; Are we on the verge of a breakdown in the markets? and I said “I find it interesting this weakness is occurring without a real catalyst from abroad just yet.” Today we had decent jobs data and what happened? the market tanked.

Please note we still need FAZ and SOXS to turn red on the weekly for me to be even more bearish.

Call: We got a little more proof of market weakness and made a few trades to that regard with tight stops in case we get thrown off for any reason.

Foreign Markets

RUSS I didn’t feel great about after the jobs data and decided to pull the plug as a scalp and took the 3% profit. But it kept going higher and triggered along with EDZ and we are long both and about flat.

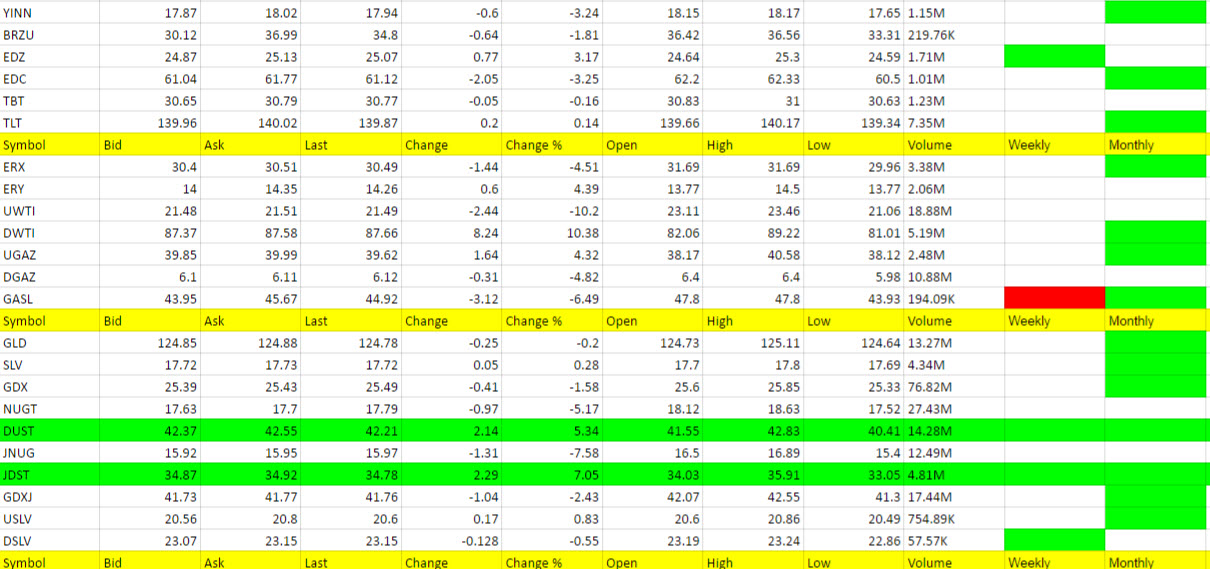

Would like the trifecta with YANG triggering soon.

Interest Rates

No call on TBT or TLT as they are still churning.

Energy

UGAZ went green again but still no call on it or DGAZ.

Yesterday i said oil looked a little weak and sure enough today we had a nice move in DWTI to 87.50. I am close to putting it on my one to watch list but not yet.

GASL finally turned negative. I don’t have GASX as one I have on the list because it does not qualify volume wise. I would trade it long at a break of 31.14 tomorrow, but no more than 100 shares because it is so volatile, and only with a Limit Order. This would be for aggressive traders only and no, I am not putting it on my list for tracking purposes. You’re on your own with it and it should be for very good traders only.

Precious Metals and Mining Stocks

While we did have the metals take off a bit lower after the jobs report today, the dollar did fall below 96 today and after being up early faltered some. I didn’t see gold continue lower by much and silver never really fell to red. I’m ok with being out of the miners right now sitting on our profit and will play the wait and see game for now.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

Click to enlarge

Related posts

Doug Eberhardt is a 28 year financial services veteran and precious metals broker selling gold and silver at 1% over wholesale cost. Doug has written a book to help investors understand how gold and silver fit into a diversified portfolio, how to buy gold and silver, and what metals to buy. The book; “Buy Gold and Silver Safely” is available by clicking here Contact phone number for Buy Gold and Silver Safely is 888-604-6534

Disclosure:

Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.